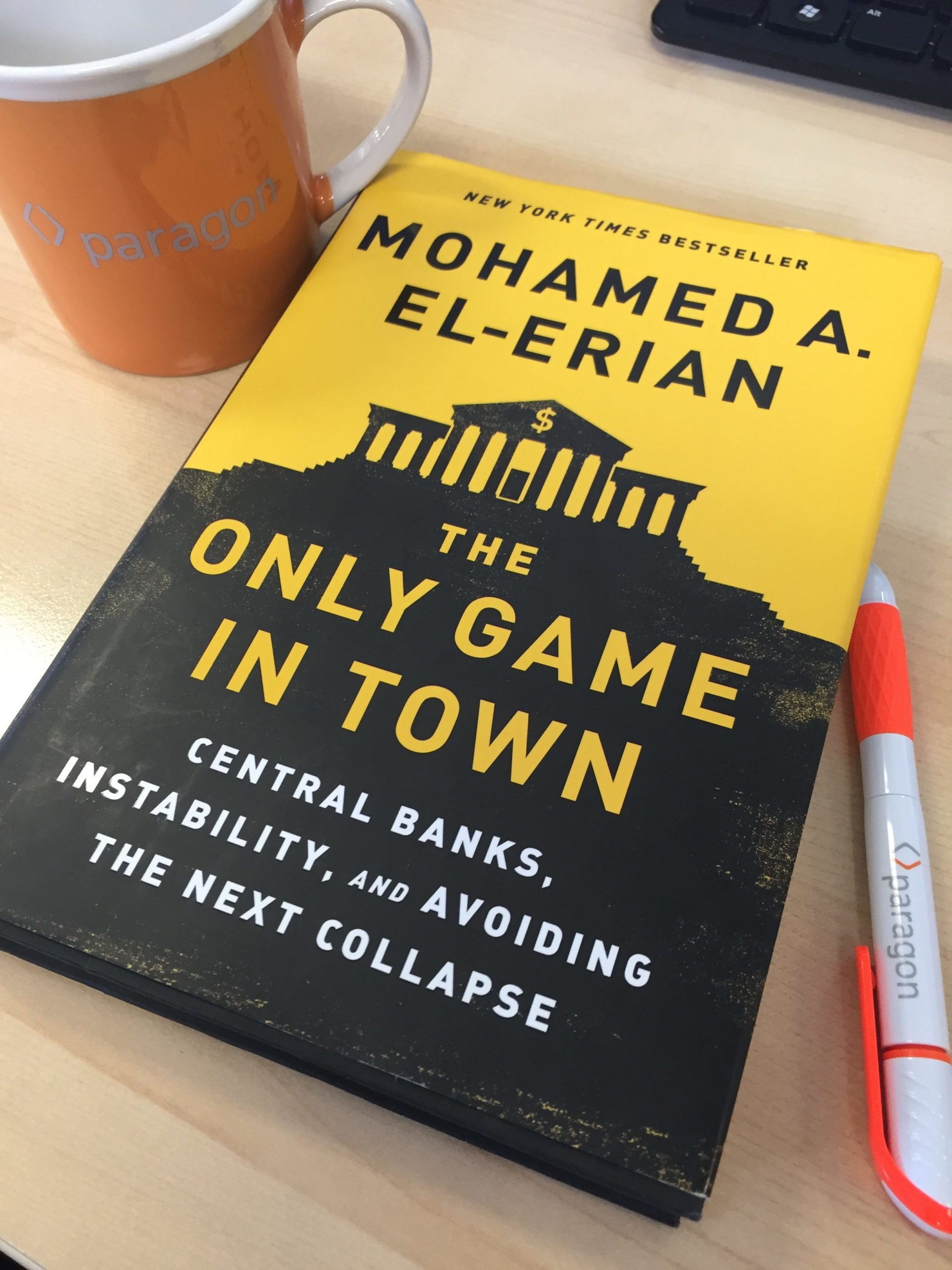

Pages with PJ: The Only Game in Town

In Pages with PJ, I will be taking a close look at books that affect the financial industry. This week, I read Mohamed A. El-Erian’s The Only Game in Town: Central Banks, Instability, and Avoiding the Next Collapse. It details how the Federal Reserve, central banks and key policymakers have impacted the global economy and how they will remain the instrumental players in sculpting capital markets well into the future.

The Financial Crisis

The global economy has now been under duress for nearly a decade. One of the primary lessons Mr. El-Erian wants to convey in his book is how pivotal a role central banks and organizations such as the International Monetary Fund (IMF) play in ensuring the world does not economically implode – as it almost did in 2008. He uses this collapse to showcase precisely how these bodies operate when the going gets tough.

Although it was central bank strategy that mitigated the crisis, central banks and major institutions were initially blamed for falling asleep at the wheel. It is important to note, as Mr. El-Erian details early on in the book, that policy makers with more sufficient tools did not step up and take the preemptive actions that were needed; and despite their initial complacency, it was the central banks that eventually steered the system to recovery.

The Fragile Banking System

As Mr. El-Erian outlined the individual events that transpired leading up to the economic crisis, I was amazed to read how befuddled even the most brilliant industry minds were as things continued to unravel in 2007. Paul Krugman, a Nobel Prize-winning economist and New York Times-contributing columnist, said he had “no idea of the fragility of the banking system,” which I would argue is a microcosmic assessment of the broader industry’s mindset during this time. Everyone, including the top banking executives, thought their approach to risk-taking and investing up to that point was sound and justified. There may never be a better time to cite Mike Tyson’s famous quote, as Mr. El-Erian did in the book, “Everyone’s got a plan until they get punched in the mouth.”

Central banks and regulators were completely unaware of how interconnected underlying factors such as mortgages and risk protocols were. In fact, Mr. El-Erian cites a personal anecdote where at height of the economic unrest, he called his wife and told her to take out the maximum amount of cash from the ATM because he didn’t think banks would be open the next day. This example resonated far more with me nowadays with the benefit of hindsight, as opposed to when it actually unfolded during my naive college years.

As of 2015, the top 10% of the US population owned 75% of country’s wealth, a statistic that helps illustrate one of Mr. El-Erian’s latter, yet equally important points in the book – central banks’ struggle to combat inequality around the world. Occurrences such as the Greece’s debt crisis have had a profound impact on economic balance. These issues have been used to demonstrate how important not only the role of central banks are, but also the IMF, and how the litany of global imbalances have hindered the organization’s ability to do its job.

Interestingly enough, these institutions are very often viewed in a negative light. Why? Because, whether it’s fair or not, they have become synonymous with financial catastrophe. As Mr. El-Erian explains, central banks and institutions like the IMF are not judged on “degree of difficulty” the way gymnastics are. If they were, their scores would always be very high. Instead, the global population, namely politicians, care solely about how the job gets done.

After reading The Only Game In Town, I’ve come away with a much better grasp on the pivotal roles that central banks, particularly the Federal Reserve Bank of the United States, play in creating monetary balance and economical stability. While their decisions may not always be popular, there are no more important players in regulating monetary equilibrium.

One of the best analogies Mohamed El-Erian provides about the functionality of the global economy was its comparison to an orchestra. Each section may sound individually sublime. But if they are all reading different sheet music or following a different conductor, it will sound awful and incoherent. The global economy is very much the same. It cannot function without cohesion between all of its parts and, as it stands now, it “needs a better global conductor.”

Do you know of any great finance or banking-related books that you’d like me to review for a future Pages with PJ column? We welcome your suggestions.

Leave a comment:

You must be logged in to post a comment.